While most investors will already be aware of asset bubbles – whether through the 1999/2000 Dotcom Bubble, the US Housing Bubble in 2007, or any number of earlier crises – you may be wondering how and if it is possible to spot potential asset bubbles. While these large economic bubbles are easy to spot in retrospect, they tend to be difficult to pinpoint at the time. The good news is that potential investors can look out for a series of characteristics to help avoid any potential bubbles.

While most investors will already be aware of asset bubbles – whether through the 1999/2000 Dotcom Bubble, the US Housing Bubble in 2007, or any number of earlier crises – you may be wondering how and if it is possible to spot potential asset bubbles. While these large economic bubbles are easy to spot in retrospect, they tend to be difficult to pinpoint at the time. The good news is that potential investors can look out for a series of characteristics to help avoid any potential bubbles.

Signs to Look For When Predicting an Asset Bubble

Here we’ll take a look at some of the main signs of an asset bubble and how investors can use these signs to identify any potential problems in the market and hopefully avoid a costly investment.

- Sharp Increase in Prices with No Improvements

One of the first major signs that an asset bubble is forming is rising prices without improving any of the underlying fundamentals of the product. For example, with the Dotcom Bubble, there was a rapid expansion of the internet market, with a significant rise in equity markets following investments in internet firms in the late 90’s. The vast majority of these Dotcom companies had very little in the way of earnings, however, they still managed to win enormous valuations. This kind of inflated valuations on the part of investors is a classic sign of an asset bubble.

- Heavy Use of Leverage

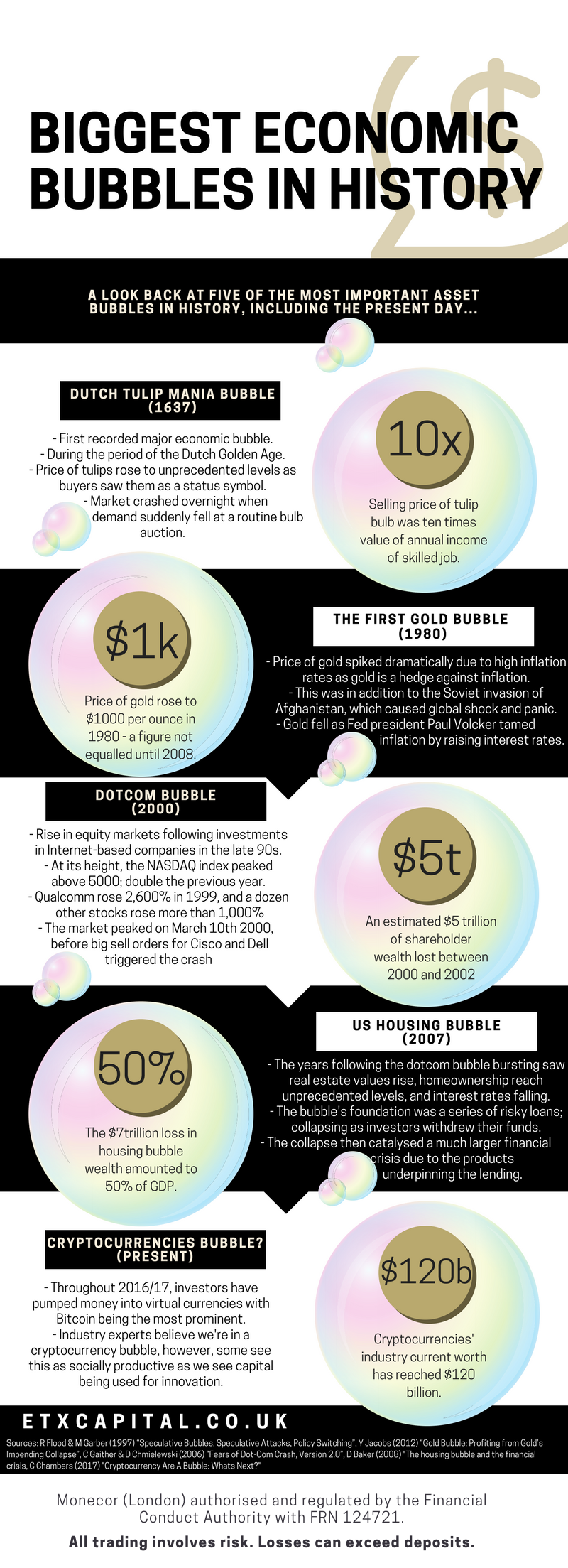

The second sign of an economic bubble is excessive use of leverage – or debt. A prime example of this is the US Housing Bubble in 2007. This mortgage crisis was caused in large part by banks offering poor credit clients access to easy money. The foundation of this bubble was a series of risky loans, which collapsed as investors withdrew funds. According to the data in the below infographic by ETX Capital, the $7 trillion loss amounted to 50% of GDP.

This collapse then catalysed a much larger financial crisis. Excessive leverage can come from a number of things including cheap money in a low-interest rate environment, financial innovations like interest-only loans and moral hazard, where individuals are protected form risk. Potential investors should watch for any situations where excessive amounts of debt may be at play.

- Political Interventions

Most modern asset bubbles can be traced back to political involvement. For example, federal regulations may create moral hazards and encourage potential investors to take on big risks. Make sure to look out for political policies that might be creating asset bubbles.

Predicting Asset Bubbles

It is notoriously difficult to predict asset bubbles. While it is easy to spot some of the tell-tale signs if you know where to look, it is far trickier to predict any price declines or a timeline around when an asset bubble will collapse.

With some economists predicting cryptocurrency as the next asset bubble, you will definitely have to do your homework before investing in any of the new cryptocurrency trading options. While some industry experts believe we are in a cryptocurrency bubble, investing in these digital currencies could still offer impressive returns for investors.

No Comments