There is plenty of advice online about how to save money for your household budget. Many experts will make it clear you should stop borrowing, and put aside money for rainy days, build up a good savings account, and free up cash in as many ways as possible.

There is plenty of advice online about how to save money for your household budget. Many experts will make it clear you should stop borrowing, and put aside money for rainy days, build up a good savings account, and free up cash in as many ways as possible.

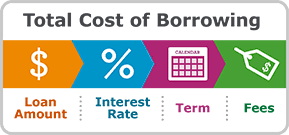

But the reality is that the vast majority of us have to borrow – it’s part of modern life. And for many households, it’s the cost of borrowing that often causes so many financial issues.

Getting into debt is something that could happen to any of us. However, money is often a subject that people don’t want to talk about.

Getting into debt is something that could happen to any of us. However, money is often a subject that people don’t want to talk about.  Money is a subject that most don’t want to talk about. Those who have enough of it don’t need to think about it much and those who don’t have it can think about nothing else! Money is a stressful subject, and we already know that feelings of depression and anxiety are linked to problems with debt.

Money is a subject that most don’t want to talk about. Those who have enough of it don’t need to think about it much and those who don’t have it can think about nothing else! Money is a stressful subject, and we already know that feelings of depression and anxiety are linked to problems with debt. Keeping your finances tight and collected as a student is a pretty hard thing to do. You’re going to be living on your own for the first time which means that money is going to be flying out everywhere to keep you going, not to mention that you’re going to be on a limited budget! With that being said, there are a few things that you can do to make sure that your finances stay in the best condition that they can, so here’s a few ways to keep you in the green!

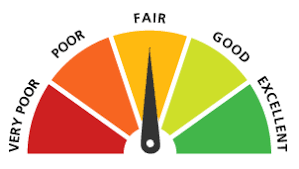

Keeping your finances tight and collected as a student is a pretty hard thing to do. You’re going to be living on your own for the first time which means that money is going to be flying out everywhere to keep you going, not to mention that you’re going to be on a limited budget! With that being said, there are a few things that you can do to make sure that your finances stay in the best condition that they can, so here’s a few ways to keep you in the green! There are two things the general public know about their credit score: it’s either good or bad! After that, the majority of us don’t have a clue about how the system works, how it affects our rating, or what that means for our financial future. If you are like most people, this realization will hit home with some force. The fact that you might

There are two things the general public know about their credit score: it’s either good or bad! After that, the majority of us don’t have a clue about how the system works, how it affects our rating, or what that means for our financial future. If you are like most people, this realization will hit home with some force. The fact that you might