The coronavirus pandemic has turned the world around for everyone. We now live in a time marked by social distancing protocols, rolling lock-downs, and increasing financial pressure.

The coronavirus pandemic has turned the world around for everyone. We now live in a time marked by social distancing protocols, rolling lock-downs, and increasing financial pressure.

Those hit by the downturn in the economy have also suffered from pay-cuts, lack of job security, and sometimes, unemployment. This is especially the case for workers in more “COVID-sensitive” industries like the hospitality sector and aviation.

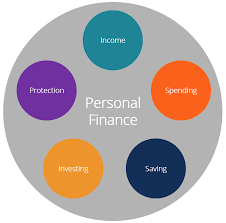

Now, more than ever, people need to know how to manage their finances.

No matter your income level, there are specific strategies you can consider employing to strengthen your financial base and manage spending at a time defined by uncertainty.

Keep reading to determine how you can begin this new year in a stress-free manner by equipping yourself with these strategies. Sometimes you may also need a little help from a professional when it comes to your finances, so you can also take advantage of cash flow planning services in Omaha or in your local area.

8 Personal Finance Strategies for 2021

The uncertainty surrounding the pandemic and how things will continue to unfold over the year is a stressor for lots of people.

However, there are certain nifty tips and strategies you can keep top-of-mind to avoid the build-up of this financial stress and best prepare yourself and your family for the coming year. ,

Here are eight strategies to help you navigate your finances in 2021.

#1. Remember the 50-30-20 Rule

Budgeting is one of the most crucial aspects of managing an effective personal finance strategy.

A great rule-of-thumb to go by is the 50-30-20 rule when planning out your expenses for each month. The rule clarifies the percentage of your income that should go toward essentials, discretionary spending and investments.

50% of your income should be spent on things you need to maintain your daily living, such as food and rent, mortgage payments, utilities, etc.

30% of your income can be spared on non-essentials and areas linked to social spending. Think: eating out with friends, traveling, gifts, etc.

The final 20% should be reserved for strategic investments, for example, in debt/equity funds and insurance schemes. These are important in the long-run as a component of long-term financial planning.

With lockdowns and social distancing, you might find your 30% being redirected to other avenues.

Take this time to better plan your expenses and weigh your needs for 2021 versus your wants. Align this with your budgeting, and you’re good to go!

#2. Start Meal Planning

A fun aspect of budgeting is meal planning.

Deciding what your weekly menu will look like in advance, getting those ingredients and cooking at home can save you money and help plan your finances better.

Through meal planning, you will be less dependent on getting food delivered from your favorite restaurants, and over time, can save sizably on this type of expenditure.

You can also limit your trips to the supermarket, avoiding the impulsive urges you may get to buy certain foods or snacks. By planning advance, you can shop and cover up to 2 weeks of your meals, allowing you to avail yourself bulk-buying cost-savings.

Bonus: you’re also doing the world a favor by staying indoors more often and being safe!

#3. Analyze Your Memberships

As you set your first steps into the new year, it’s a good time to put your monthly and annual memberships under the microscope.

Have a look over the memberships you’ve subscribed to, be it social clubs, gyms, software subscriptions, or even your local library membership. Do you see the pattern of usage changing in the coming year?

It’s natural that with COVID still around, you may think twice about hitting up the gym regularly. If you haven’t used certain services for an extended period of time, it’s a good idea to cancel your memberships and save money on the monthly fees. You can always renew it later.

Pro-tip: ease up on your streaming services too!

Having been indoors for the majority of 2020, you might have also subscribed to more entertainment channels impulsively. Juggling multiple streaming services like Netflix, Hulu, PrimeVideo, and more can be unnecessary if you’re only using a few of them in your free time.

#4. Lower Your Car Insurance

Do you own a car? If yes, over the last year, how often did you take it out for a spin? Less frequently, I imagine.

One of the associated costs of owning a car is the insurance premium you pay for it. The number of miles you drive is one factor used to calculate the premium by insurance companies.

With a remote work lifestyle on the rise, the daily commute has been canceled and replaced by a home office’s comforts. This is expected to continue well into 2021. 81% of managers believe having teams made up of remote workers will become the new normal.

This is a great time to lower your insurance premium payments by getting in touch with your insurance company and letting them know your lower mileage.

Take your savings further by also learning DIY car maintenance hacks. Think: changing air filters, indicator lights, or replacing a tire.

Your car is an asset, and the better you take care of it, the more long-term savings you make too. You can take this time to learn these basics, knowledge that will surely benefit you even after the pandemic ends.

#5. Buy Smart Stocks

If you’re thinking of selling your investments: don’t.

While the stock market has run rampant with increased instability and uncertainties affecting the outlook, many investors have been tempted to pull out of their schemes or sell their stocks. This is a mistake because eventually, the market will rebound.

Instead, you could look to contribute more funds into less risky areas like your retirement/pension funds.

Now is also a great time to purchase stocks of famous firms whose prices will have devalued currently. In the long run, the appreciation of their values can give you large returns.

#6. Refinance Your Mortgage

If you’re juggling a mortgage as part of your financial obligations, it’s time to refinance.

In December, US mortgage rates declined to an all-time low of 2.67% for a 30-year fixed-rate.

This means you can save hundreds of dollars per month by signing off on a refinance agreement to your mortgage terms. You can even think about shortening the term period for your loan, meaning you can pay it off faster and free yourself of debt obligations.

Pro-tip: ensure the drop in interest is beneficial enough to offset expenses faced in closing costs.

#7. Leverage Aid Programs

Do you have a student loan? Or are you running a small business? Did you lose your job due to COVID?

Look into aid and relief programs that you are eligible for. Local governments have rolled out and implemented such aid programs to help their communities cope better.

Whether it’s availing a low-interest loan to keep your business thriving or signing up for unemployment benefits, it can help you better manage your money as you wait for the economy to pick up again.

#8. Build An Emergency Fund

If ever there is a case built for having emergency savings, 2020 is one of the most compelling examples.

Maintaining an emergency fund can literally save your financial health at times when you least expect it.

It’s vital to assess your monthly expenses and have at least three months’ worth in savings, just to keep you prepared.

A great way to do this is by going over your monthly expenses from October to December. Arrive at a total figure that consists mainly of your primary expenditure, cut out the non-essentials, and you’ll know how much to allocate to an emergency fund.

Be Savings Savvy in 2021

If it hasn’t already, the trickle-down effects of the economic downturn will undoubtedly be felt by you and others in the coming year. While markets will eventually rebound and financial conditions will improve, there’s no telling with absolute certainty when that will happen.

Prepare your finances for 2021 with these so you can best strengthen yourself for what’s to come.

It’s time to take control of your money!

About the Author

Beatrice Manuel is a freelance writer for hire specializing in finance and digital marketing. She helps brands fulfill their vision through words by producing sparkling content pieces that convert. When she isn’t helping her clients win readers, you’ll find her working on her next novel and posting on her literary blog.

No Comments