Millions of aspiring immigrants wish to achieve the American dream, no matter how long and daunting the road appears. The process is complex, but you can get through with the right approach and awareness. Most importantly, you must go the extra mile with financial planning to avoid wasting money and ensure a strong position when you land in the US. Financial stability makes the transition to a new country smooth and painless. Let us share the best money advice aspiring American immigrants can rely on.

Millions of aspiring immigrants wish to achieve the American dream, no matter how long and daunting the road appears. The process is complex, but you can get through with the right approach and awareness. Most importantly, you must go the extra mile with financial planning to avoid wasting money and ensure a strong position when you land in the US. Financial stability makes the transition to a new country smooth and painless. Let us share the best money advice aspiring American immigrants can rely on.

Budgeting

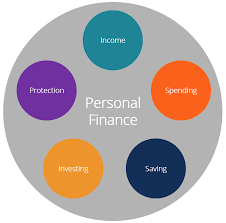

Understanding financial matters is something we all pick up as we go through life, but for some, the gaps in knowledge about certain aspects are wider than with others. Having a basic financial literacy is useful for many reasons and helps us make better decisions when it comes to money. Knowing where to start isn’t always easy, so here are 4 financial topics that you should know more about.

Understanding financial matters is something we all pick up as we go through life, but for some, the gaps in knowledge about certain aspects are wider than with others. Having a basic financial literacy is useful for many reasons and helps us make better decisions when it comes to money. Knowing where to start isn’t always easy, so here are 4 financial topics that you should know more about.

The coronavirus pandemic has turned the world around for everyone. We now live in a time marked by social distancing protocols, rolling lock-downs, and increasing financial pressure.

The coronavirus pandemic has turned the world around for everyone. We now live in a time marked by social distancing protocols, rolling lock-downs, and increasing financial pressure.

Those hit by the downturn in the economy have also suffered from pay-cuts, lack of job security, and sometimes, unemployment. This is especially the case for workers in more “COVID-sensitive” industries like the hospitality sector and aviation.

It can be argued that strict budgeting is far more important for low incomes compared to high ones. When you need to know precisely where each and every penny is going, you need to also make sure that you have given yourselves the tools to allow it. Here are three tips you can use to make sure you are budgeting effectively.

It can be argued that strict budgeting is far more important for low incomes compared to high ones. When you need to know precisely where each and every penny is going, you need to also make sure that you have given yourselves the tools to allow it. Here are three tips you can use to make sure you are budgeting effectively.

When you have a family and a home, cash flow is an essential part of your finances and your well-being. It is important to not only save money, but to have money keep flowing to have a handle on how much money you need to have on hand at any given time. The lack of funds is not always the result of low income or costly expenses but a lack of financial literacy and a problem with the flow of cash.

When you have a family and a home, cash flow is an essential part of your finances and your well-being. It is important to not only save money, but to have money keep flowing to have a handle on how much money you need to have on hand at any given time. The lack of funds is not always the result of low income or costly expenses but a lack of financial literacy and a problem with the flow of cash.