Millions of people struggle with student loans when they graduate. Even if they make their monthly payments, research shows that over 60% of current student loan holders expect to be paying off their student loans in their 40s. A combination of high debt and high interest can extend the life of a loan.

As a result, more people are turning to refinancing as an option to take control of their student loan debt. Let’s find out how refinancing can save you both time and money as you pay off your loans.

3 Ways Refinancing Can Save You Money on Your Loans

Taking out a loan comes with its own costs that many people don’t consider. The length of your repayment term affects the monthly payment. The interest also changes how much you will end up paying in addition to the principal amount.

When you decide to refinance, here are three ways it could save you money on these costs:

Choosing a longer repayment plan can reduce your monthly costs, but it may increase interest paid in the long-term.

- When you refinance, you can choose lower interest rates based on your current situation and credit score.

- Should you decide to shorten your repayment term, you will make higher monthly payments, but you will accrue less interest over the life of the loan.

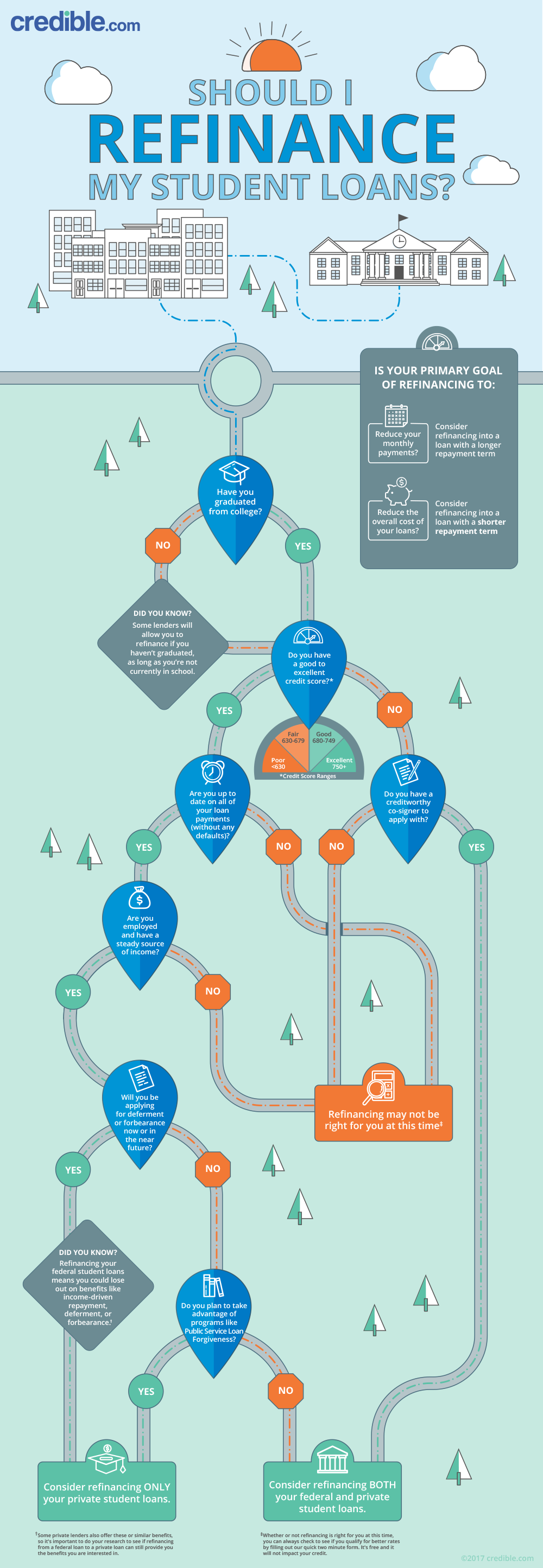

Check out the infographic below for some help deciding if refinancing is right for you. If you decide to move forward, today’s top private lenders can help you consolidate and change the terms of your loan to better meet your needs.

No Comments